The Basics of Micro PE: The Right Price and The Right Terms

The market is a wonderful imaginary thing, especially in micro PE. I mean, any deal is about finding the right price for which the seller is willing to sell and the buyer is willing to buy.

But between these two prices lies a pretty broad area in which the terms of a deal can be at least as important as the price itself, because a deal is more than just the price: it's the conditions under which the price is paid, to whom, when and under what terms.

In this edition, I will share some insights from finding the right price by benchmarking against industry multiples and provide a handful of examples of deal structures that are at least equally important to bring a deal to close.

Finding the right price

As a general rule, the less mature the asset, the less historical data is available to make an informed decision.

This means less revenue data to read trends, less customer feedback to understand product maturity, and so on.

When looking at a potential acquisition target in micro PE, you would typically look for businesses that are not operating at their full potential.

This involves understanding where they may be falling short, such as:

- Broken distribution

- Broken business model

- Broken user experience

- Broken technology

Once the areas for improvement have been identified, it's about finding a fair price for the business. Generally speaking, there are two common approaches to valuing a SaaS business:

- Revenue multiples (typically ARR)

- Profit multiples (typically TTM)

Since the focus of most micro PE funds is less on high-growth, VC-funded rocket ships, and more on slowly but steadily growing, profit-oriented businesses, profit multiples have become the de-facto standard for this type of investment.

Especially when debt is used to finance a transaction, known as a leveraged buy-out (LBO), profits tend to matter more than just revenue.

The most popular marketplace, Acquire, publishes a biannual report on profit multiples of deals that have been facilitated through their platform.

It's worth reading, as it captures macro economic trends quite well and provides transparency for buyers and sellers like.

Let's dive in.

The latest report, published in January 2024, highlights that on average, SaaS businesses were acquired at a 4.3x Trailing Twelve Months (TTM) profit multiple.

Some businesses were acquired for as little as 0.63x, while others fetched as much as 34x TTM profit (where TTM profit > $1,000).

This broad price spectrum suggests that price alone is not the only factor that determines the success of a deal.

Another interesting aspect is how prices fluctuate over time. In 2022, the average confirmed TTM profit multiple was at 5.4x, while only a year later it dropped to 4.3x.

Finding the right terms

The goal for any buyer is to leverage the cash at hand as much as possible. Hence finding the perfect terms can make or break a deal.

Upfront cash payments are the easiest deals to conduct, though there is a spectrum of possibilities in terms of how much cash is provided upfront, at a later point and under what conditions.

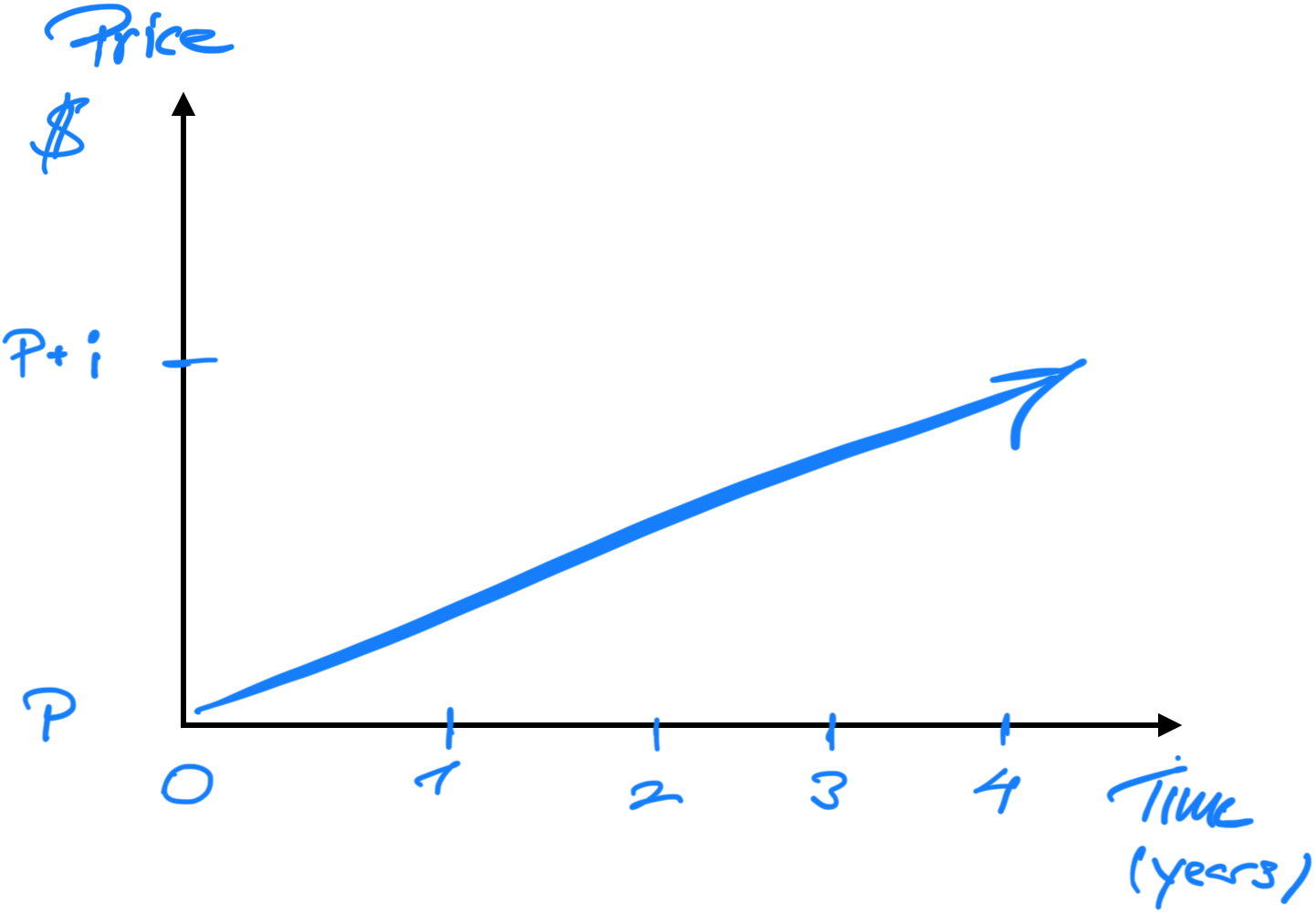

Generally speaking, the total payment increases if cash payments are delayed into the future.

Let's look at a few examples by considering a hypothetical B2B SaaS application that is for sale:

A team collaboration tool that enables silent, pantomime-based communication between distributed employees. Perfect for introvert-friendly teams!

➡️ MRR: $3.2k • TTM Profit: $32.5k • Price: $140k

The Upfront Model

This is the easiest deal structure for both sides, especially when the buyer has cash available. Depending on the preference of the seller, this usually is the quickest form of transaction, too.

- Total payment: $140,000

- Expected earnings for seller: $140,000

- Upfront payment: $140,000

- Remaining payment: None

- Revenue Share: None

The Extra Income Model

In this model, the seller stays involved, but usually has little to no decision power over the course of the business.

- Total payment: $150,000 + revenue share

- Expected earnings for seller: ~$165,000+

- Upfront payment: $30,000

- Remaining payment: $120,000 (see below)

- Revenue share: 10% (see below)

Remaining payout

- Year 1: $30,000 /year or $2,500 /month

- Year 2: $30,000 /year or $2,500 /month

- Year 3: $30,000 /year or $2,500 /month

- Year 4: $30,000 /year or $2,500 /month

Revenue share

- Year 1-4: 10 % of monthly revenue after crossing $2,500/mo.

The Growth Model

This model allows the seller to participate in the future growth of the business with a stronger involvement post transaction if compared to the Extra Income Model.

- Total payment: $160,000 + revenue share

- Expected earnings for seller: ~$177.000+

- Upfront payment: $10,000

- Remaining payment: $150,000 (see below)

- Revenue share: 10-20% (see below)

Remaining payout

- Year 1: $30,000 /year or $2,500 /month

- Year 2: $30,000 /year or $2,500 /month

- Year 3: $30,000 /year or $2,500 /month

- Year 4: $30,000 /year or $2,500 /month

- Year 5: $30,000 /year or $2,500 /month

Revenue share

- Year 1 & 2: 10% of revenue crossing $2,500/month

- Year 3 & 4: 15% of revenue crossing $2,500/month

- Year 5: 20% of revenue crossing $2,500/month

The Partner Model

This deal structure does not include any upfront payment and has the highest involvement post transaction for the seller. The total payment is highest in this model, but payments are stretched over a multi-year period.

- Total payment: $180,000 + revenue share

- Expected earnings for seller: ~$229.000+

- Upfront payment: $0

- Remaining payment: $180,000 (see below)

- Revenue share: 50-10% (see below)

Remaining payout

- Year 1-5: $36,000 / year or $3,000 /month

Revenue share

- Year 1: 50% of revenue crossing $3,000/month

- Year 2: 30% of revenue crossing $3,000/month

- Year 3: 20% of revenue crossing $3,000/month

- Year 4: 20% of revenue crossing $3,000/month

- Year 5: 10% of revenue crossing $3,000/month

Be ready to get creative

See the deal terms above more as food for thought, as no single transaction is the same. The good news is that the more creative the buyer can be, the more likely a deal is to close as long as both sides stay incentivized.

Every deal is different and the key is finding the right balance between the buyer's and seller's interests to reach an agreement both sides benefit from.

Ultimately, a successful deal comes down to understanding the nuances of each situation and being willing to explore alternative structures beyond just the upfront price.