The Basics of Micro PE: Where and What to Buy

In this edition, you will learn where a micro PE fund looks for opportunities and what criteria they have to meet.

I will also dive deeper into some of your most frequent questions, such as:

- Who would even sell a company so early?

- What do you really get for such a price?

- Can this really be a business?

And you will learn about venture zero of the Waterglass portfolio, Mailpengu.

Where to find opportunities

The easiest and most straight forward way to find relevant acquisition targets is to use marketplaces specialized in buying and selling startups.

There are a handful that focus on matching sellers with buyers in this space and the most well-known are probably Acquire and Flippa, next to newcomers like Microns and a few independent mailing lists.

Especially deals below $50k are snatched up very quickly when the valuation is fair, which means you have to be fast to get the creme de la creme of opportunities.

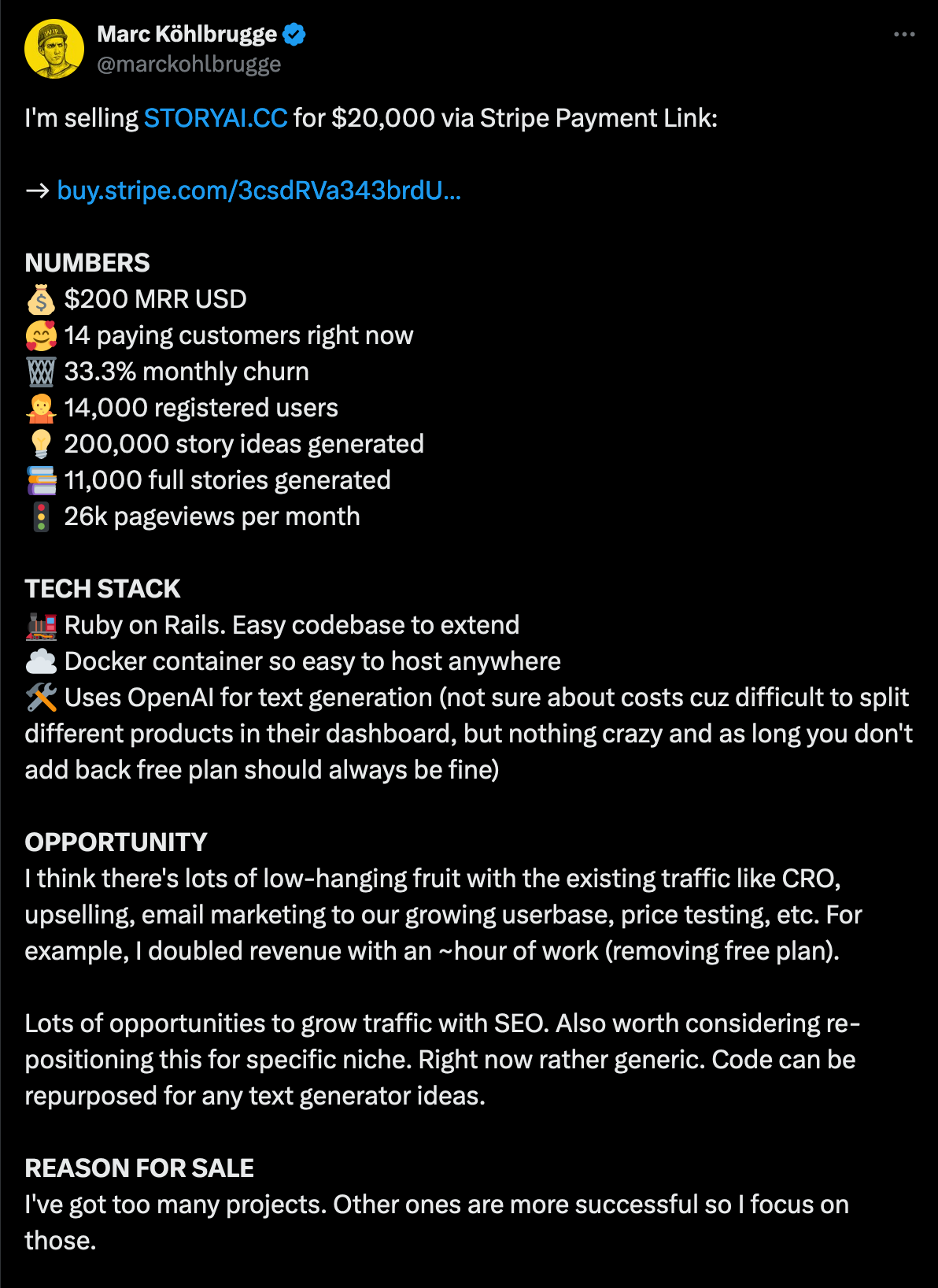

Other, oftentimes overlooked off market channels for discovering relevant assets are Twitter (X) or communities like Indie Hackers or Product Hunt.

Why? Because asking for a sell is oftentimes easier than being among many buyers to compete for an asset once the founder decided to actually sell.

The downside is, you have to get in touch with many builders to find the one who is selling their business that matches your profile.

It's a numbers game, really.

But some are even selling their business pro actively on Twitter (X), as seen in the example below by Marc Kohlbrugge. The MRR to price ratio is debateable, but the traction is impressive nonetheless:

Communities like Indie Hackers and Product Hunt are another treasure chest of side projects that have launched a while ago, gained some traction and were then put on auto pilot to merely exist in the endless void of what we used to call the 'cyberspace.'

A lot of opportunities await there for people who know what to look out for. However, building trust and relationships is key when approaching founders pro actively on such communities.

What to acquire

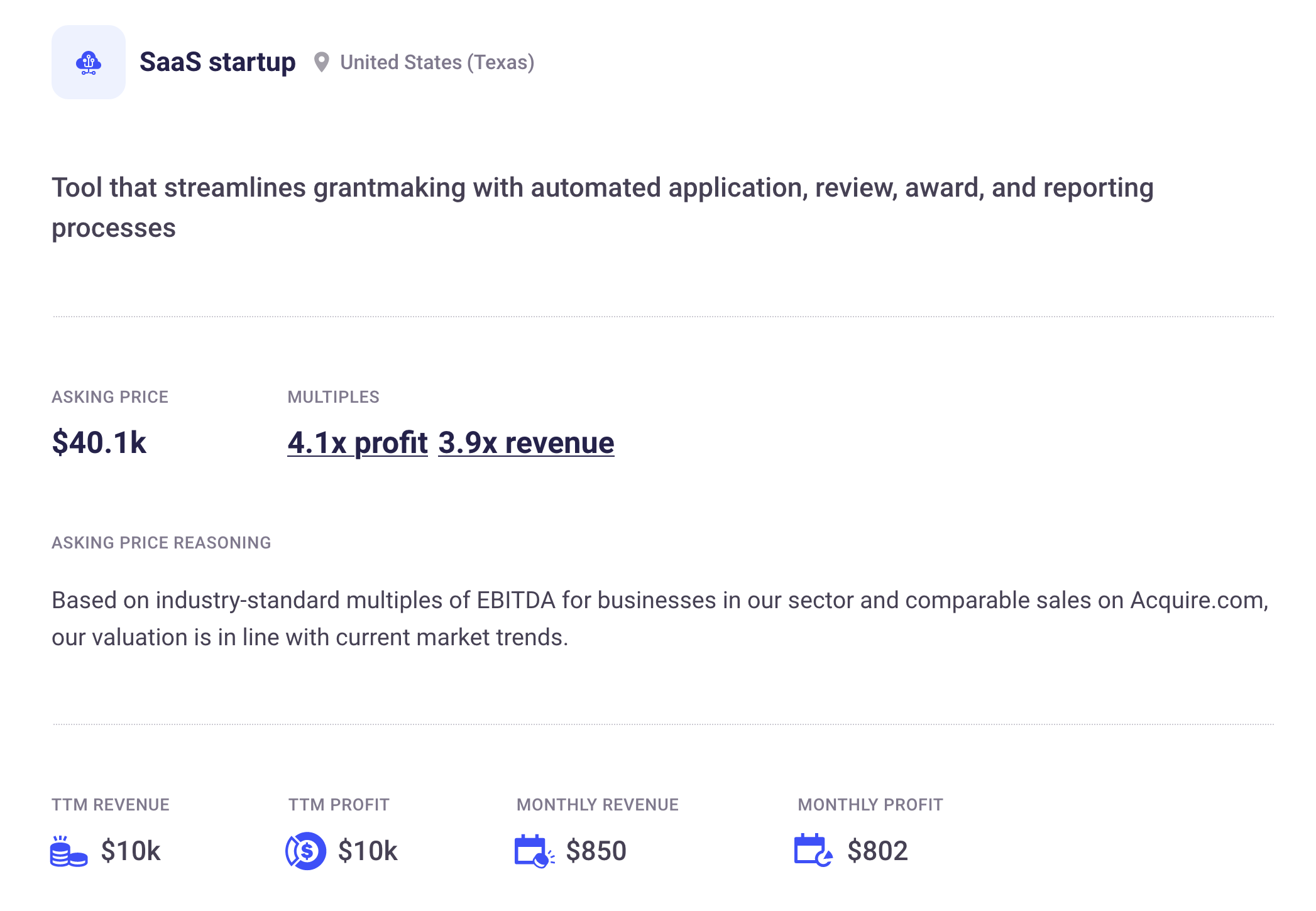

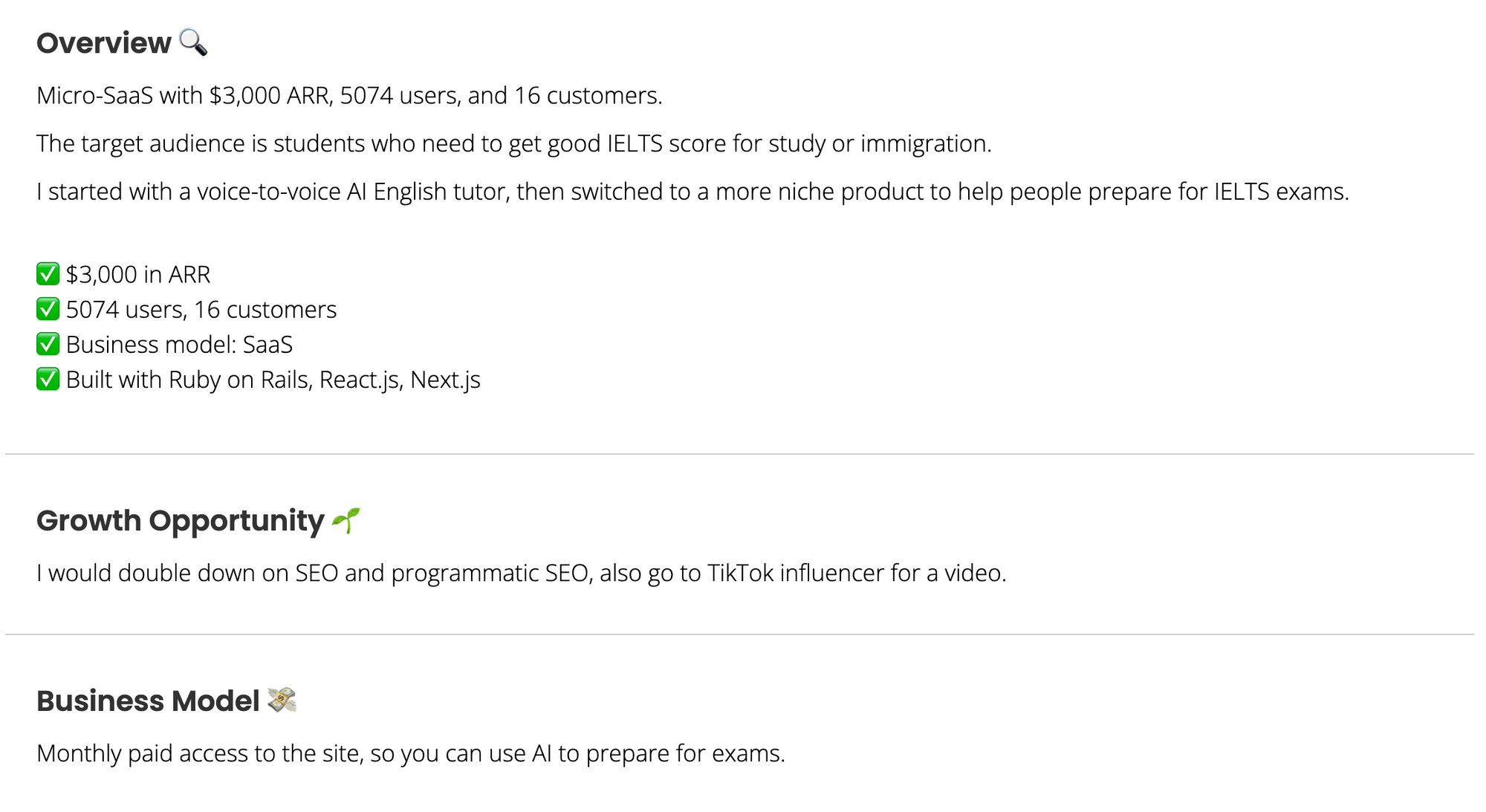

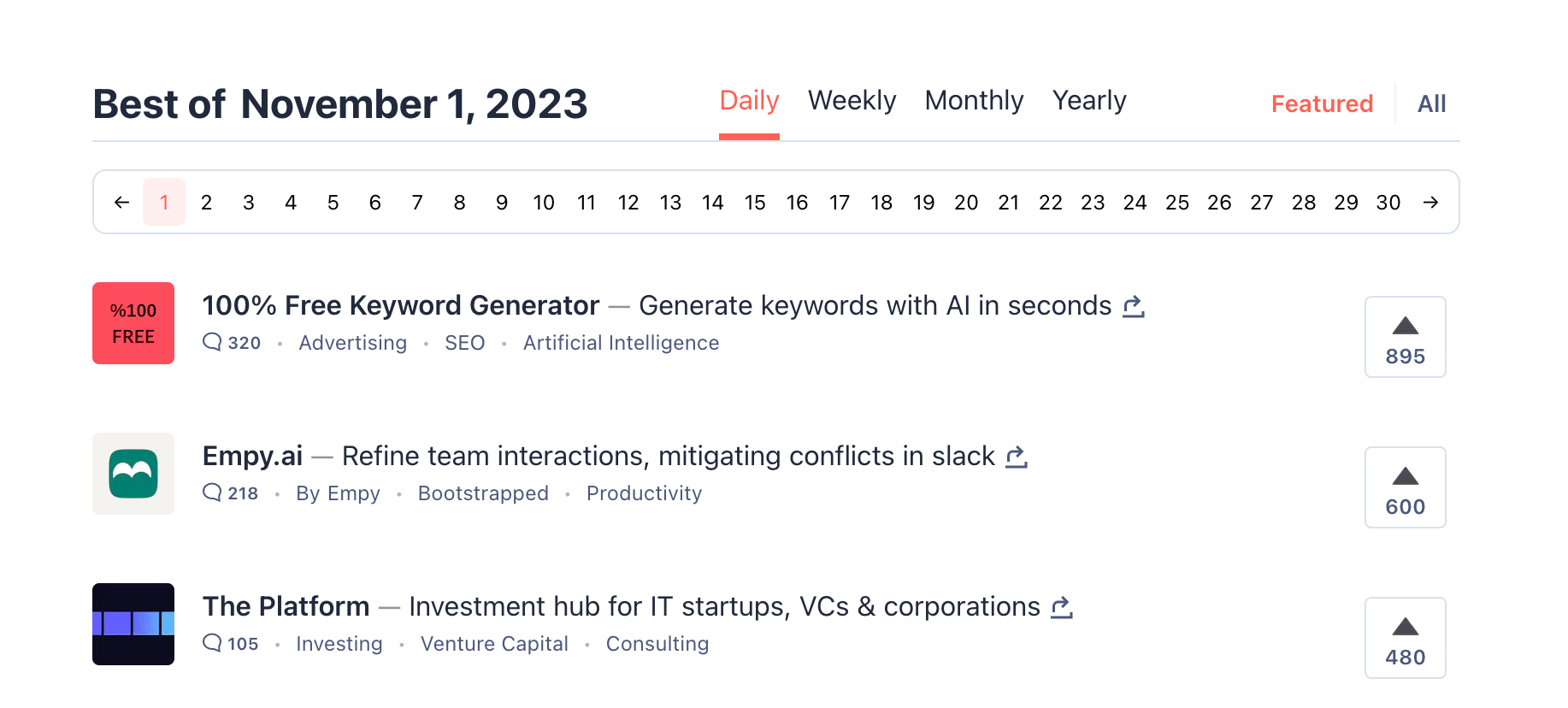

The focus of Waterglass is to acquire assets early on, especially once they show first signs of traction:

For bootstrapped founders, growing a business from o → 1 is hard by itself, but taking it from 1 → 10 usually means hiring team members, dividing responsibilities and getting started with actual marketing and sales beyond just shitposting on Twitter (X).

This quickly grows beyond the capacity and skills of the solo founder who started the business in the first place. Which means, this is the ideal time to acquire.

The acquisition profile you see above will grow over time, especially the minimum MRR requirements, which are oftentimes closely connected the sales price.

The goal in Waterglass' year one is to acquire up to three assets and then grow them to 'ramen profitability' by initially investing my own capital.

By the end of the first year, I plan to grow the portfolio on this foundation by niching down and ideally build synergies across the portfolio, possibly with external capital at some point.

Your most frequently asked questions

The deal size is so small, how can this be a business?

In simple terms, a business is a function of revenue, expenditures and profits. Since the only fixed cost in the beginning is my moderately sized ego, this gives me flexibility to shape the fund as needed.

Over time, deal sizes will grow which means more cash flow will be reinvested in further growth, team and future deals.

Who would even sell a business so early?

What many underestimate is just how many projects are up for sale and fall under the acquisition profile above, because the founders have two or more side projects and want to focus on either of them.

Once it's about hiring people and growing a team to keep the momentum up, many solo founders consider selling their businesses, because they want to stay independent. The cash they get from the sale is then oftentimes reinvested another venture of their portfolio.

What do you really get for such a price?

Realistically, if you purchase an asset below $50k, what you will get is a slightly more advanced MVP.

However – and this is a big however – this business has already made some progress towards Product-Market-Fit by acquiring customers and generating revenue, which means it reduced the overall risk of success.

Once this far, it's about executing clever strategies to continue the path towards PMF to grow a profitable business under the portfolio.

Do you have a team in place?

Yes, while on one side I can cover a broad range of tasks myself and use automation to my advantage, it's engineering support that I get from the agency I co-run and partner with:

This allows me to manage costs quite agile while being able to double down on growing the portfolio.

Speaking of which:

Welcome to the portfolio, Mailpengu

A quick toour of Mailpengu. Did you see the dancing penguin?

A couple of weeks ago I started testing how LLMs can be used to create products – and I was blown away by the results.

I'm convinced that the future of product development will heavily rely on co-pilots that engineers work alongside with, similar to how we work at MVP.AG.

What I managed to do within just a week was:

- Create a Python-based Flask application that analyzes online presentations

- Write a Javascript-based Chrome Extenstion that hooks into Gmail and interacts across different server environments

- Deploy everything on Google Cloud Platform

It's truly crazy times we live in.

Mailpengu will be rolled over into the portfolio as venture zero which means it's technically not the a real acquisition as it was built internally and is pre-revenue, but I see a potential fit with the rest of the upcoming portfolio that I have in mind.

You can sign up on the website to get onboarded by me. I also added a small easter egg.

Do you want to see a penguin dance?

← In case you missed the previous edition